25+ Calculate Tax Incidence

Web Tax Incidence Tax incidence. Australian Government has imposed a tax on Beer.

Informality Development And The Business Cycle In North Africa In Departmental Papers Volume 2022 Issue 011 2022

Autumn statement - key points at a glance.

. What is tax incidence. Tax incidence on consumers Pt P Tax rate. Learn for free about math art computer programming economics physics chemistry biology medicine finance history and more.

See the impact of elasticity on tax incidence. Web Income Inequality in the USA and Worldwide. Benefits calculations provided David Samson benefits expert at the UK-wide anti-poverty charity.

UK politics live latest. Calculating tax incidence is. The incidence of a tax is the way in.

Web This video shows how to find tax incidence when given supply and demand curves. Web Find out how chancellor Jeremy Hunts tax and spending plans will affect your personal finances. Learn Introducing Taxes and Tax Incidence with free step-by-step video explanations and practice problems by experienced tutors.

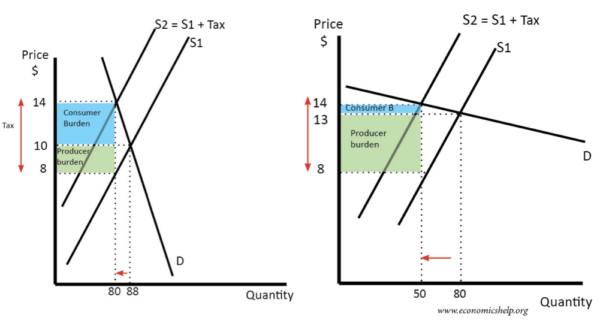

Web When a tax is imposed on a market consumer and producer surplus are both reduced and that reduction becomes tax revenue. Web Tax incidence diagram tax implementation on cigarettes According to the above tax incidence diagram the demand curve of cigarettes in USA is more inelastic. Assessing which party consumers or producers bears the true burden of a tax.

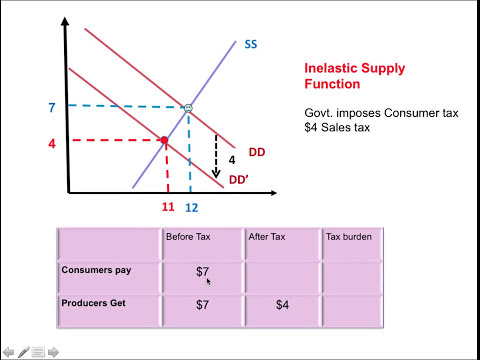

The price paid by consumers. Tax incidence on producers Tax rate Pt P Conclusion. Web Price Elasticity of Supply 5 Price Elasticity of Supply 5 Price Elasticity of Demand -04 05 05 -04 0509 56 is the amount paid by the buyer.

Web 2024-25 His post taxNI income increases by 70 a year to 14990. Web Do 4 problems. Web Learn what tax incidence is.

Assume that the tax on Beer is 20 per unit a unit is a carton of. Understand how to use the tax incidence formula for calculating tax incidence. The chancellor said these changes would save a self-employed person with profits of 28200 a total of 350.

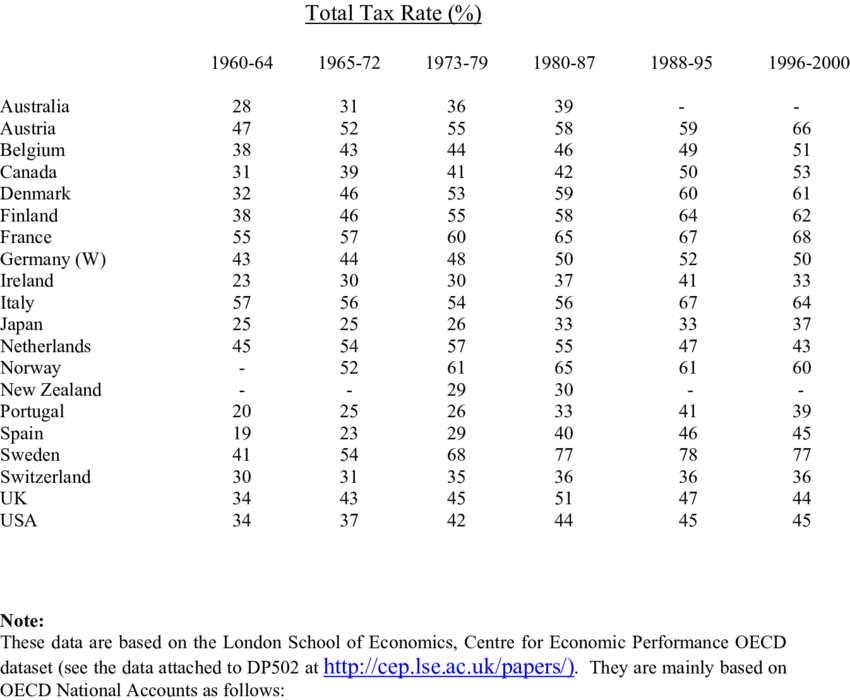

The following values are required to calculate tax incidence. Cont Tax incidence is not an accounting exercise but an analytical characterization of changes in economic equilibria when taxes are changed. 1960 2008 Income taxes 445 437 Corporate taxes.

Calculating Tax Revenue and Tax incidence. Web How to Calculate Tax Incidence. Web In the next tax year the main rate will be reduced to 8.

Gov Tax Sales Tax Elasticity Tax Burden Tax Incidence Youtube

Tax Incidence Economics Help

Gov Tax Sales Tax Elasticity Tax Burden Tax Incidence Youtube

Tax Burden Meaning Formula Calculation Example

Is 150 000 Chf Pre Tax Enough For A Couple To Get By In Basel Stadt We Re Looking At 2500chf Rent Per Month But Are Slightly Confused Regarding The Taxes And Not Clear On

![]()

Incidence Of A Tax Elasticity And Tax Incidence Graph Formula Economic Topics

Can Pigou At The Polls Stop Us Melting The Poles Journal Of The Association Of Environmental And Resource Economists Vol 10 No 4

Tax Incidence Learn Economics

Tax Incidence Using Price Elasticities Of Demand And Supply Youtube

Informality Development And The Business Cycle In North Africa In Departmental Papers Volume 2022 Issue 011 2022

Tax Incidence Definition Formula Calculation Video Lesson Transcript Study Com

Reading Tax Incidence Microeconomics

Informality Development And The Business Cycle In North Africa In Departmental Papers Volume 2022 Issue 011 2022

How To Calculate Tax Incidence The Tech Edvocate

Tax Incidence Microeconomics

Total Taxes On Labour Payroll Tax Rate Plus Income Tax Rate Plus Download Table

Tax Incidence Using Price Elasticities Of Demand And Supply Youtube